- Crypto mining or cryptocurrency mining is defined as the process of solving computational problems to verify and add a transaction to the blockchain to earn a digital currency as a reward for expounding the computational resources.

- The process of crypto mining is extremely resource-intensive and can involve costly rigs. Users can leverage specialized integrated circuits or rent cloud space to run crypto mining computations. Crypto mining efficiency is measured in hashes per second.

- This article explains the key concepts underlying the crypto mining process, its steps, and its types.

Table of Contents

What Is Crypto Mining?

Crypto mining or cryptocurrency mining is the process of solving computational problems to verify and add a transaction to the blockchain to earn digital currency as a reward for expounding the computational resources. The process of crypto mining is extremely resource-intensive and can involve costly rigs. Users can leverage specialized integrated circuits or rent cloud space to run crypto mining computations. Crypto mining efficiency is measured in hashes per second.

A Bitcoin mine in Quebec, Canada. Creating new coins is highly energy intensive, requiring hundreds of specialised computers to run almost 24/7. (Image: Christinne Muschi / Alamy)

Mining is the process by which Bitcoin and other cryptocurrencies create new coins and authenticate new transactions. It necessitates massive, decentralized computing systems around the globe that validate and safeguard blockchains — the online ledgers that store cryptocurrency transactions. Machines that contribute processing power to the network receive reimbursements via new coins.

This is a profitable (but resource-intensive) circle for all. Miners manage and safeguard the blockchain, which then distributes the coins, and the coins act as a reward for the miners to continue supporting the blockchain.

In addition to releasing new currency into movement, mining is essential to the security of cryptocurrencies. It confirms and protects the blockchain, allowing cryptocurrencies to work as a decentralized peer-to-peer system without needing third-party regulation. In addition, it encourages miners to offer their computing capacity to the network as a whole.

Evolution of crypto mining

The rise of crypto mining can be broken down into eight phases:

- Initial conceptualization: In 2008, Satoshi Nakamoto published the paper Bitcoin: A Peer-to-Peer Electronic Cash System. In 2009, he published the first Bitcoin software. That was the official starting point for crypto mining.

- Fledgling popularity: Bitcoin quickly gained recognition as more and more individuals became interested in currency decentralization and a government-free economy. This sparked the building of nodes, mining new Bitcoins, and safeguarding of the network.

- Lack of long-term viability: In 2009, a machine equipped with an Intel Core i7 processor was capable of mining approximately 50 Bitcoins per day. Previously, when a Bitcoin was valued at $0.08, Bitcoin producers paid more for power than they made from Bitcoin transactions.

- More efficient alternatives: The difficulty of mining cryptocurrencies via PCs on the Bitcoin network led to the developing of high-end graphics equipment. In 2010, miners started employing graphics processing units (GPUs) to mine Bitcoins.

- New cryptocurrencies: GPUs allowed them to compute cryptographic hashes with greater speed than CPUs (central processing units). GPU mining systems included a central processing unit, a chipset, and six top-of-the-line graphics cards. At the same time, several other crypto alternatives to blockchain appeared since its long-term value and viability were now clear.

- Further advancements: In 2011, miners began searching for GPU substitutes with lower power consumption. They discovered field-programmable gate arrays (FPGAs) capable of mining Bitcoins twice as quickly as the most advanced GPU. To efficiently process currencies, FPGAs required complex hardware and software configuration and customization.

- Crypto mining at scale: Miners sought out new devices that didn’t need hardware or software parameter reprogramming as FPGAs were labor-intensive. Canaan Creative, a computer hardware manufacturer in China, introduced application-specific integrated circuits (ASICs) in 2013. ASICs, instead of FPGAs, GPUs, or CPUs, mine Bitcoin exclusively, thereby contributing to efficiency gains.

- Crypto mining as a service: Today, various software as a service (SaaS) platforms simplify crypto mining by doing all the backend work, including cloud-hosted infrastructure. Mobile Miner, Genesis Mining, OXBTC, and Minosis are examples of this trend.

How Does Crypto Mining Work?

Cryptocurrency mining primarily relies on high-quality computational hardware and a plentiful electricity supply. As the blockchain has expanded, the computational capacity necessary for operating it has also evolved. According to Coinbase, in October 2019, it took 12 quadrillion times more computing capacity to mine a single Bitcoin than it did in January 2009 when the first blocks were mined.

The steps for crypto mining are fairly straightforward:

1. Assembling the hardware

Dedicated processors execute the calculations necessary to verify and register each fresh cryptocurrency activity and ensure the integrity of the blockchain. Validating the blockchain requires an enormous quantity of processing power, which is provided voluntarily by miners.

2. Maintaining the hardware

Large-scale crypto mining is comparable to overseeing a large data center. Individuals or businesses acquire the mining machinery and purchase the power it needs (and cooling) to keep it operational. For this to be economically viable, the worth of the coins earned must be greater than the cost of mining them. As discussed later, mining hardware can include generic processing units or specialized integrated circuits.

3. Finding the solution to the crypto problem

The blockchain network conducts a lottery, which is the cryptocurrency computational problem. Every machine on the computer network competes to predict a 64-digit hexadecimal figure called a ‘hash correctly.’ The quicker a computer can generate projections, the higher the miner’s chance of getting the reward.

4. Adding transactions to the blockchain

The winner refreshes the blockchain ledger to reflect all the newly validated exchanges, thus creating a newly verified ‘block’ comprising all transactions. This individual (miner) receives a predetermined quantity of newly created cryptocurrency. This occurs approximately every 10 minutes if you’re mining cryptocurrencies.

Now that we have a basic understanding of how crypto mining works, the following few essential terms will help you understand its technical operation.

- Rig: A mining setup is a specialized piece of hardware, usually centered on the layout of graphics cards, used to mine cryptocurrency. The rig usually has universal serial bus (USB) ports, wires, and a motherboard to function as a self-sustained unit.

- Node: These are mining device components responsible for validating trades and introducing fresh blocks to the blockchain. They execute sophisticated computations to solve mathematical problems, which enables them to create new blocks and collect cryptocurrency as compensation.

- Hash rate: Hash rate is a gauge of the network’s computational capacity. It is typically measured in million hashes per second (MH/s) or trillion hashes per second (TH/s).

- Mining pool: A mining pool is the gathering of resources by miners who distribute their computational power across a network to divide the reward equally based on the quantity of work they put in against the probability of discovering a block.

- Energy usage efficiency: Energy consumption efficacy is measured in terms of hashes per kilowatt-hour. This helps miners evaluate the compensation and the cost associated with electricity.

- Gas fee: A gas fee is a transaction fee that must be paid to carry out an action on the blockchain network, irrespective of the success or failure of the transaction in question. When end users use crypto, they pay a gas fee to companies or service providers mining and processing the crypto on their behalf.

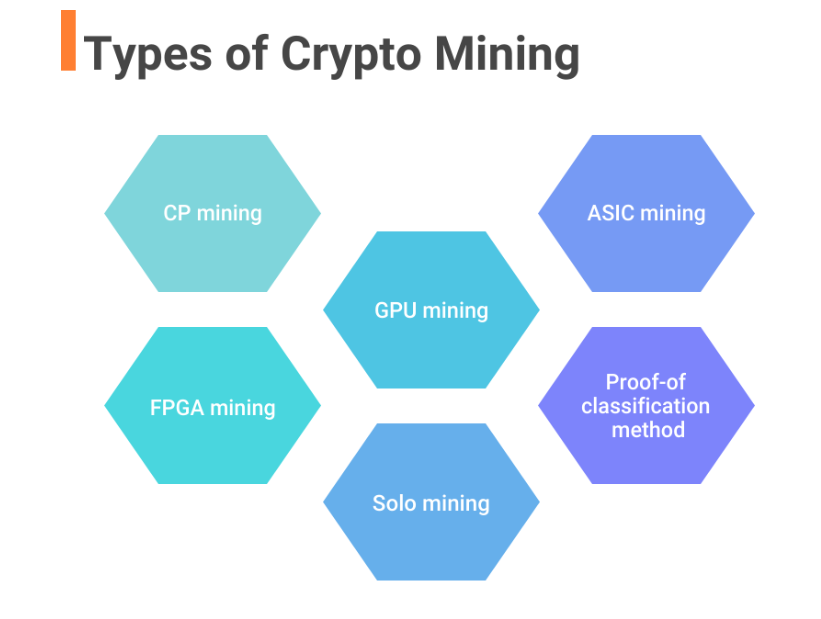

Types of Crypto Mining

Crypto mining can be classified into several types based on the mining method and how many stakeholders are involved in the mining operation. The most notable types of crypto mining are:

Types of Crypto Mining

from spiceworks.com

1. CPU mining

This is one of the most common types of crypto mining since it requires no specialized equipment and can be performed by anyone. Here, you harvest cryptocurrencies through your PC’s central processing unit (CPU). The arithmetic logic units (ALUs) in central processing units perform sophisticated arithmetic and logical operations, enabling the CPU to carry out complex calculations and functions. Anyone with a desktop PC can use their CPU’s computational capacity to validate cryptocurrency transactions and solve sophisticated algorithms. This method of mining is referred to as CPU mining.

Proof of work (PoW) is typically utilized by CPU mining as the proof of task completion and the addition of new currencies, thereby becoming eligible for compensation. However, CPUs cannot solve repetitive or long mathematical equations. Given that CPUs cannot compute large volumes of mathematical data, cryptocurrency miners have shifted to graphics processing unit mining.

2. GPU mining

A majority of large-cap crypto miners began earning mining rewards through CPU mining. Soon, they realized that even with enormous power consumption, CPUs have limited outcomes. At that time, miners began mining using graphical processing units or video devices. One or more GPU devices can be utilized to solve and verify complex equations and cryptographic transactions.

GPUs offer faster hash rates due to their arithmetic logic units, which is the primary distinction between CPU and GPU mining. As such, GPUs can solve intricate mathematical equations faster. GPU mining relies on the processing capacity of mining graphics cards to validate crypto transactions or generate new currencies. This resolves difficult cryptographic equations faster than CPUs.

Importantly, this form of crypto mining employs various hashing algorithms to convert data of any dimension into a fixed-size hash. This enables GPU mining platforms to compress data into a more compact format, making it compatible with larger volumes.

3. ASIC mining

This type of cryptocurrency mining employs specialized hardware and algorithms to execute a specific task. Since these devices house powerful processors, they surpass GPU and CPU mining relatively easily.

An application-specific integrated circuit (ASIC) is a computerized device designed for a particular function, in this case, mining digital currency. Every ASIC miner is typically designed to extract a particular digital currency. Consequently, a Bitcoin ASIC miner will only harvest Bitcoin.

ASICs are specialized integrated circuits aimed at mining cryptocurrencies instead of functioning as general-purpose integrated circuits, such as random access memory (RAM) processors or central processing units (CPUs). Consequently, they complete the task faster than slower and less powerful processors.

It is important to note that mining is modifying a few integers on a hash to discover one smaller than the target or original hash. The greater the number of computations that can be conducted in a given period, the higher the possibility a miner will earn cryptocurrency. ASIC mining devices are optimized for rapidly computing hash functions.

4. FPGA mining

This type of crypto mining became popular after the rise (and fall) of CPUs and GPUs in the cryptocurrency world but before the rise of ASICs. Field-programmable gate arrays (FPGA) are electrical circuits that can be configured to conduct predefined logical operations. As a result, FPGA mining devices can be designed for mining a specific cryptocurrency.

The advantage is that, if necessary, FPGAs can be reconfigured to mine an alternate cryptocurrency via a separate mining algorithm but with the need for specialized model training. They are as much as five times more energy-efficient than GPUs and will probably help you break even (in terms of setup costs for cryptocurrency mining) in a couple of years.

However, the supremacy of FPGA miners was short-lived as ASICs soon emerged to entail lower costs and better energy efficiency. In addition, FPGAs may be unable to keep pace with large-scale GPUs working on more advanced nodes.

5. Cloud mining

Another type of crypto mining to consider is cloud mining. Just as you can purchase cloud storage to fulfill your data storage needs, you can buy a cloud mining package or subscription from a cloud mining vendor. This would enable you to mine cryptocurrencies without incurring the upfront expenses and maintenance costs for specialized mining hardware.

Contracts for cloud mining typically differ in duration (from a few weeks to several years) as well as hash rate. In many instances, these services can be priced competitively since the cloud mining vendor usually possesses numerous warehouses packed with high-efficiency ASIC miners.

You can also virtually hire ASIC miners, although this option is far less popular than it once was. It provides the cloud miner greater flexibility but requires additional installation and upkeep expenses.

When undertaking cloud mining, it is important to select a trustworthy vendor. In the early stages of cloud mining, there were several crypto frauds known as exit scams in which consumers paid for contracts with fraudulent companies that vanished without delivering on their promises.

6. Solo mining

The previous five types of crypto mining are classified based on the mining method. Now, we’ll look at two types of mining as per the number of people involved. The first one is solo mining.

In solo mining, also called individual mining, miners process cryptocurrency individually. They operate the mining process independently and are not reliant on third-party support. Solo miners with individual mining devices are rewarded handsomely for large-scale detection within their native cryptocurrency clients. Two factors are essential for the success of solitary mining: hardware capacity and network complexity.

The central characteristic of solo mining is that a miner can obtain answers to complicated block data in a short amount of time, or it may take a long time. Solo miners must, therefore, maintain forbearance. However, it may offer consumers substantially greater returns over time than pool mining. Bear in mind that fluctuations in cryptocurrency prices and power consumption costs will also influence the financial viability of solo mining.

7. Pool mining

Not everyone has the financial means to engage in solo mining. That’s why crypto miners devised a method for sharing computational power and resources to increase the probability of discovering blocks. These organizations are known as pool miners, and their method is known as pool mining.

Mining pools merge the hashing power of several miners to produce outputs comparable to those of major mining operations. Pool miners obtain proportional block incentives according to their contributing proportions and only after submitting proof of work for transactions. The secret to effective pool mining is delivering more hashing power over each round.

Solo miners possess their own nodes yet can employ multiple mining machines or devices. For instance, Jane has twenty rigs. She constructs her very own node and places 20 separate devices on it. She is currently mining cryptocurrency on her own and endeavoring to authenticate transactions on the blockchain.

The user becomes a pool if Jane permits other people’s access to her node. She must now divide the profits according to the total quantity of shares supplied by each miner. This also increases the chances of solving the mathematical blockchain calculation in a shorter time and earning money.

In solo mining, miners use a trial-and-error method to confirm blocks, while in pool mining, miners collaborate to ensure an uninterrupted income stream.

8. ‘Proof-of’ classification method

Another way to classify the types of crypto mining is based on the type of proof used. Proof of work or PoW is the most common concept, which helps verify the amount of energy and resources spent vis a vis the amount of cryptocurrency earned.

- Proof of work (PoW)

Proof of work is a form of zero-knowledge cryptographic evidence in which one party (prover) reveals to others (verifiers) that a certain quantity of a particular computational undertaking has been executed. Proof of work aims to safeguard users from double-spending or printing unearned currency. Bitcoin is one of the most well-known cryptocurrencies that utilize PoW.

- Proof of coverage (PoC)

Proof of coverage is a technique employed by certain blockchain networks, such as Helium. Using radio frequencies, the algorithm validates that Hotspots supply legitimate wireless connectivity and coverage.

Hotspots are a Helium-specific term for wireless network hubs, which act as miners and send data to devices. PoC validation is accomplished by introducing new blocks, completing new tasks, and compensating miners. Hotspots accept instructions (or ‘challenges’) to transmit cargoes to nearby Hotspots to observe, validate, and hand over crypto rewards to partake in a proof-of-concept process.

- Proof of space (PoSpace)

Proof of space is a method used to demonstrate an actual interest in an offering by designating a non-trivial quantity of memory or disk space to tackle the task put forward by the service provider.

In Bitcoin, miners compete to discover PoWs. The miner who discovers it broadcasts the new block to the entire network. The block is attached, the miner receives the reward, and the miner starts expanding this new block. Utilizing a proof system such as PoSpace, any miner can instantaneously calculate a PoSpace. The network of blockchain miners determines who ‘wins,’ and everyone proceeds to the next block. Spacemint is an instance of a blockchain system that facilitates PoS-based crypto mining.

- Proof of stake (PoS)

Proof of stake asserts that a user’s ability to generate or verify block transactions is proportional to the number of coins they possess. As a result, the more coins a miner controls, the greater their mining power. Ethereum 2.0 mines cryptocurrencies, besides Tezos, Cardano, Solana, and Algorand, using proof of stake.

93184.22USD

93184.22USD 83.56USD

83.56USD 2.31USD

2.31USD 0.15USD

0.15USD 3275.32USD

3275.32USD 13.22USD

13.22USD 915.2USD

915.2USD 140.77USD

140.77USD 0.11USD

0.11USD 0.05USD

0.05USD 0.13USD

0.13USD

Favorites

Favorites History

History